Residential Real Estate News

Mortgage Delinquency Rates in U.S. Drop to Record Low in May

Residential News » Irvine Edition | By Michael Gerrity | July 27, 2023 8:29 AM ET

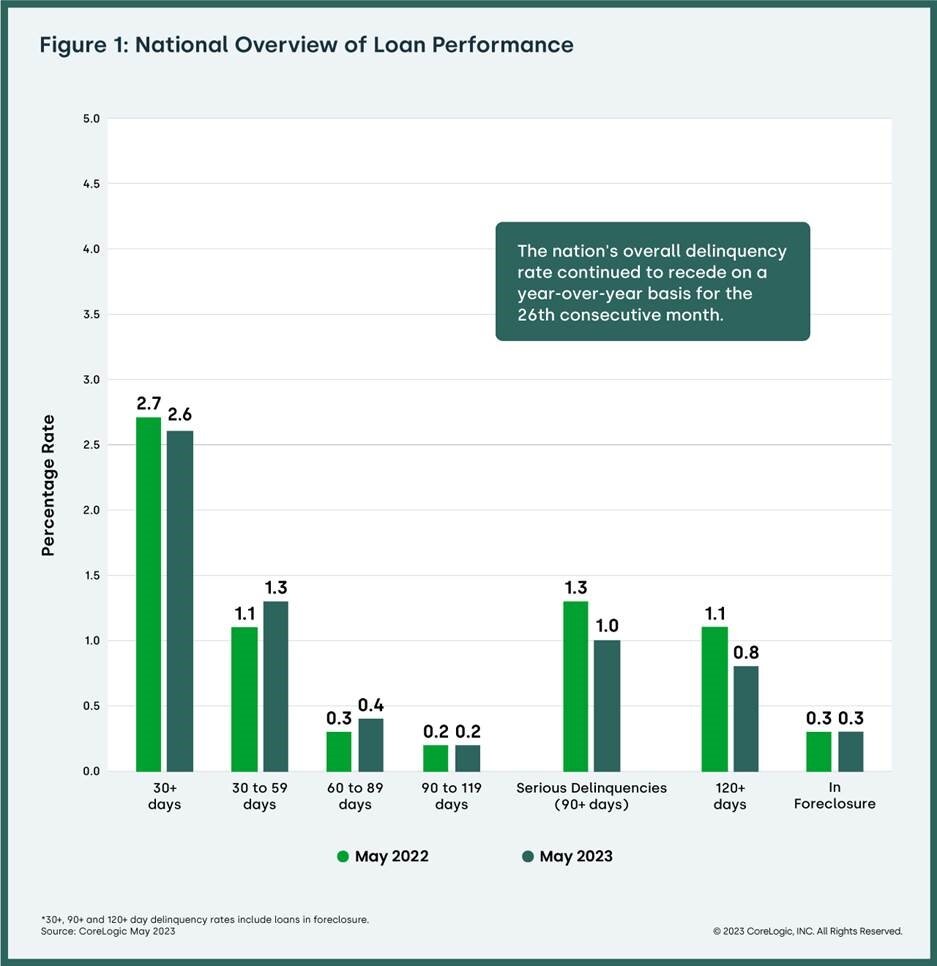

Based on CoreLogic's latest monthly Loan Performance Insights Report for May 2023, 2.6% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 0.1 percentage point decrease compared with 2.7% in May 2022 and a 0.2 percentage point decrease compared with 2.8% in April 2023.

To gain a complete view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency. In May 2023, the U.S. delinquency and transition rates and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.3%, up from 1.1% in May 2022

- Adverse Delinquency (60 to 89 days past due): 0.4%, up from 0.3% in May 2022.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 1%, down from 1.3% in May 2022 and a high of 4.3% in August 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, unchanged from May 2022.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, unchanged from May 2022.

The U.S. overall mortgage delinquency rate again fell to a historic low in May, returning to the level seen in March of this year, while the near-all-time low foreclosure rate has not changed since spring 2022. However, 14 states and nearly 170 metropolitan areas saw overall delinquencies increase year over year in May, similar to April data. Still, despite this pattern and gradually declining U.S. home price gains over the past year, overall mortgage performance remains quite healthy, boosted by steady employment numbers.

"May's overall mortgage delinquency rate matched the all-time low, and serious delinquencies followed suit," said Molly Boesel, principal economist at CoreLogic. "Furthermore, the rate of mortgages that were six months or more past due, a measure that ballooned in 2021, has receded to a level last observed in March 2020."

"A very strong job market continues to help borrowers pay their mortgages on time," Boesel continued. "The U.S. economy has added nearly 25 million jobs since April 2020 and about 4 million in the last year. As a result, the unemployment rate has ranged from 3.4% to 3.7% for the past 16 months. While the job market may slightly weaken over the next year, we project that mortgage performance will remain healthy."

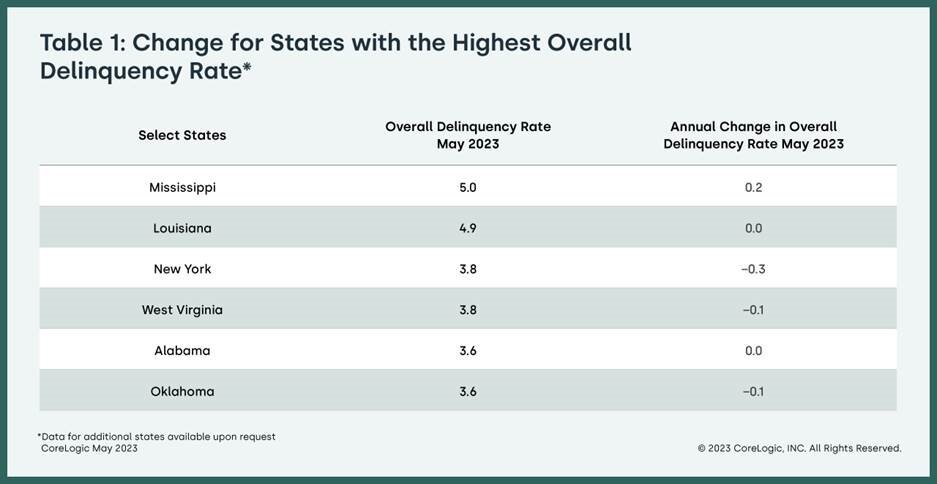

State and Metro Takeaways

- Fourteen states posted an annual increase in overall delinquency rates in May. The states with the largest increases were Idaho, Indiana, Michigan, Mississippi and Pennsylvania (all up by 0.2 percentage points). An additional 14 states saw no change in overall delinquency rates year over year. The remaining states' annual delinquency rates dropped between 0.3 and 0.1 percentage points.

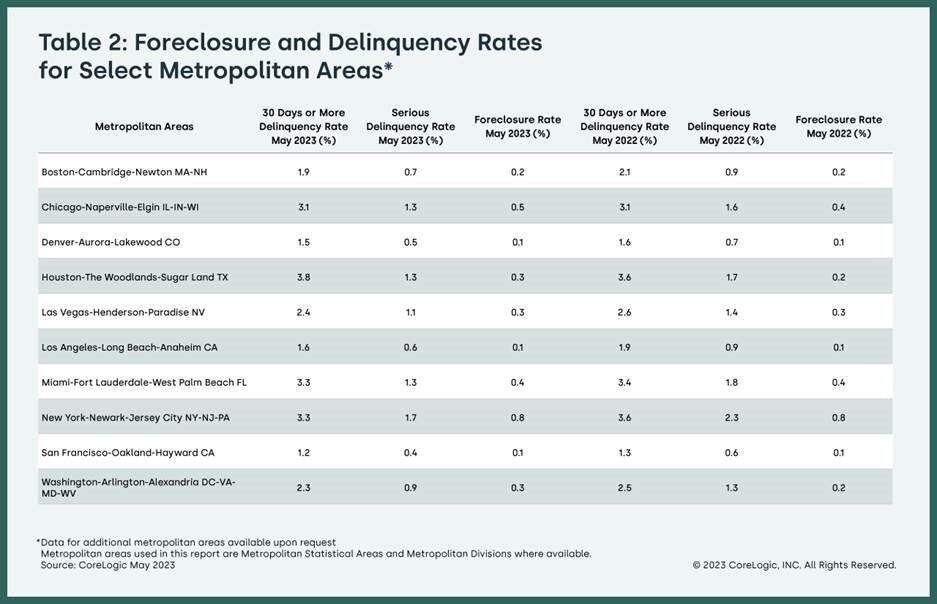

- In May, 168 U.S. metro areas posted an increase in overall year-over-year delinquency rates. Elkhart-Goshen, Indiana and Punta Gorda, Florida (both up by 1 percentage point) led, followed by Cape Coral-Fort Myers, Florida and Lubbock, Texas (both up by 0.9 percentage points).

- Three U.S. metro areas posted an increase in serious delinquency rates (defined as 90 days or more late on a mortgage payment) in May, while changes in other metros ranged between -1.3% and 0.0%. The metros that saw serious delinquencies increase were Cape Coral-Fort Myers, Florida and Punta Gorda, Florida (both up by 0.7 percentage points) and Elkhart-Goshen, Indiana (up by 0.2 percentage points).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Migration to Most Flood-Prone Areas Has Doubled Since the Pandemic

- Mortgage Rates Slightly Dip in Mid-July in the U.S.

- New Home Mortgage Applications Spike 26 Percent in June

- U.S. Home Sales Down 23 Percent in First Half of 2023 Says NAR

- Despite Rising Rate Concerns, Builder Confidence Edges Higher in July

- Just One Percent of Homes Have Changed Hands This Year in the U.S.

- Mortgage Rates Rise Again in U.S.

- Rent Growth for Single Family Homes Continues to Slow in May

- Home Values in U.S. Reach New Peaks in June

- Orlando Area Residential Sales Down 18 Percent Annually in June

- Homebuilders Tell Congress ESG Policies Harm Affordable Housing Production in the U.S.

- Globally, Waterfront Properties Enjoy a 118 Percent Price Premium in 2023

- U.S. Foreclosure Starts Increase 15 Percent in First Half of 2023

- U.S. Residential Asking Rents Still Close to Record High in June

- U.S. Housing Inventory Drops to Lowest Levels Since 1999, Says NAR

- Annual Home Price Growth in America Drops to 11 Year Low in May

- Southwest Florida Housing Markets Hit by Hurricane Ian Bouncing Back

- Mortgage Delinquencies Remain Near All-time Lows in U.S.

- Global Home Price Growth Slows to Lowest Levels Since 2015

- Mortgage Rates in U.S. Reach New High in 2023

- Greater Las Vegas Area Home Sales Down 14 Percent Annually in June

- U.S. Mortgage Applications Dip in Late June

- Greater Palm Beach Area Residential Sales Dip 6 Percent in May

- Americans Prefer Walkable Communities

- Phoenix, Las Vegas and Miami Most Popular Destinations for Family Relocations in 2023

- U.S. Pending Home Sales Dip in May

- Ireland Home Prices Dip Nationwide in Q2

- U.S. Homes Post First National Price Declines in Over a Decade

- U.S. Homebuyer Affordability Further Declined in May

- Luxury Branded Residences Enjoy Global Growth Despite Economic Uncertainties

- Greater Fort Lauderdale Area Home Sales Dip 12 Percent Annually in May

- Mortgage Applications in U.S. Increase in Mid-June

- Greater Miami Residential Sales Continued to Slide in May, Down 25 Percent Annually

- U.S. Home Sales Slightly Upticked in May

- Investor Home Flipping Profits Remain at 10-Year Lows in Q1

- Active Home Listings For Sale in America Fell to a Record Low in May

- New Home Starts in U.S. Spikes 22 Percent Annually in May

- Buyers Pay More for Homes Painted in Darker Moody Colors in 2023

- U.S. Housing Market Has 40 Percent Less Active Listings in 2023 Than Before the Pandemic

- Greater Orlando Area Home Sales Down 20 Percent Annually in May