Residential Real Estate News

U.S. Home Prices Uptick 3 Percent Annually in July

Residential News » Seattle Edition | By WPJ Staff | July 31, 2023 7:50 AM ET

Biggest annual home price increase since November 2022

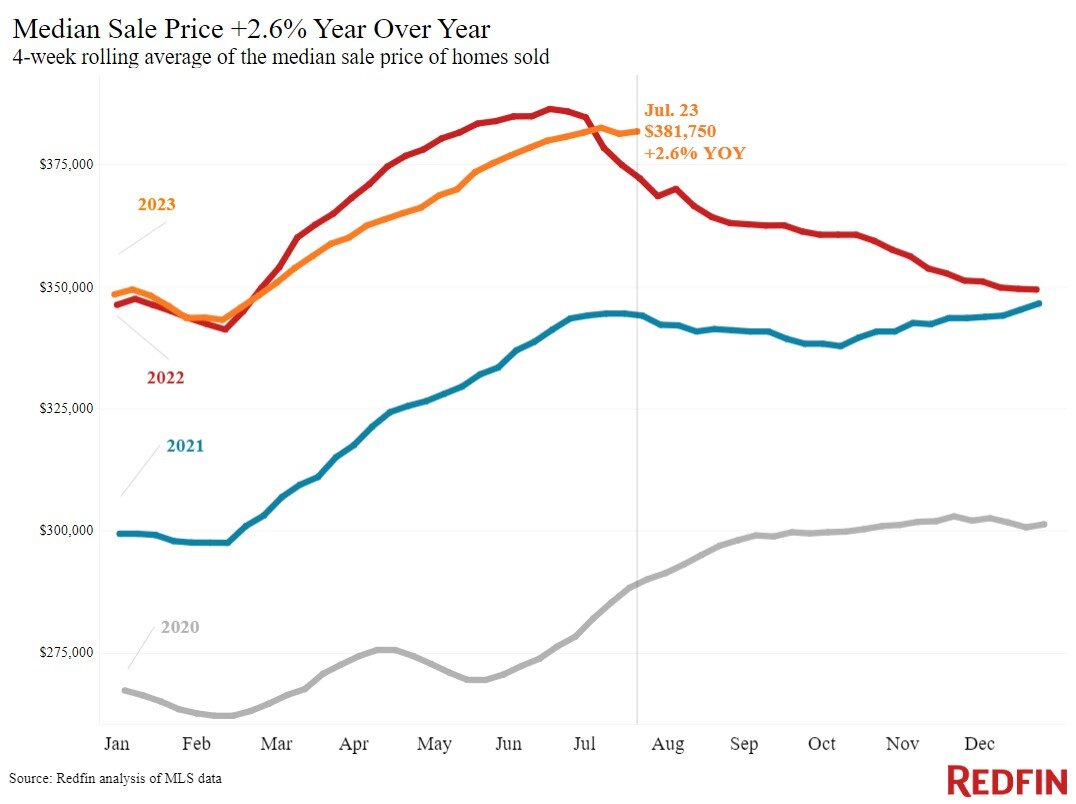

According to national property broker Redfin, the typical U.S. home sold for roughly $382,000 during the last week of July 2023, up 2.6% from a year earlier, the biggest increase since November.

Still, homebuyers are getting a bit of relief as mortgage rates inch down from the eight-month high hit a few weeks ago. The typical monthly mortgage payment is $2,599 at today's average weekly rate, down $55 from the all-time high of $2,654 in early July.

Today's housing market is unusual because prices are increasing despite lukewarm demand. Redfin's Homebuyer Demand Index--a measure of requests for tours and other home buying services from Redfin agents--is down 3% from a year ago, and mortgage-purchase applications are down about 23%. But inventory has dropped more than demand, with homeowners hanging onto their comparatively low mortgage rates, which is sending prices up. New listings are down 22% from a year ago, and the total number of homes for sale is down 17%, the biggest decline in a year and a half. Pending sales are down 15%, partly because the lack of inventory is tying potential homebuyers' hands.

This week's news that the Fed is no longer forecasting a broad economic recession is hopeful for the housing market, despite the simultaneous interest-rate hike. The Fed indicated that a soft landing is more likely than they had previously thought, which would mean interest rates went high enough to tame inflation but not enough to cause a surge in unemployment and send the economy into a recession.

"This is hopeful news for the housing market in a few ways," said Redfin Economic Research Lead Chen Zhao. "Avoiding a recession means Americans will hold onto their jobs, for the most part, and feel more confident about purchasing big-ticket items like a house. Steady progress on taming inflation means that while mortgage rates will probably stay elevated for at least a few months, they're likely to start coming down before the end of the year. That should encourage some sellers and buyers to jump into the market."

Leading indicators of homebuying activity:

- The daily average 30-year fixed mortgage rate was 6.95% on July 26, up slightly from a week earlier. For the week ending July 20, the average 30-year fixed mortgage rate was 6.78%, down from a half-year high a week earlier.

- Mortgage-purchase applications during the week ending July 21 declined 3% from a week earlier, seasonally adjusted. Purchase applications were down 23% from a year earlier.

- The seasonally adjusted Redfin Homebuyer Demand Index was down 3% from a year earlier, the first decline after eight straight weeks of increases.

- Google searches for "homes for sale" were up essentially flat from a month earlier during the week ending July 22, and down about 6% from a year earlier.

- Touring activity as of July 23 was up 11% from the start of the year, compared with a 4% decrease at the same time last year, according to home tour technology company ShowingTime.

Key housing market takeaways for 400+ U.S. metro areas:

- The median home sale price was $381,750, up 2.6% from a year earlier. That's the biggest increase since November.

- Sale prices increased most in Miami (11.9% YoY), Milwaukee (9.3%), Cincinnati (8.9%), Anaheim, CA (8.3%) and West Palm Beach, FL (7.4%).

- Home-sale prices declined in 20 metros, with the biggest drops in Austin, TX (-8.8% YoY), Detroit (-6.4%), Phoenix (-4.7%), Las Vegas (-3.9%) and Sacramento (-3.8%).

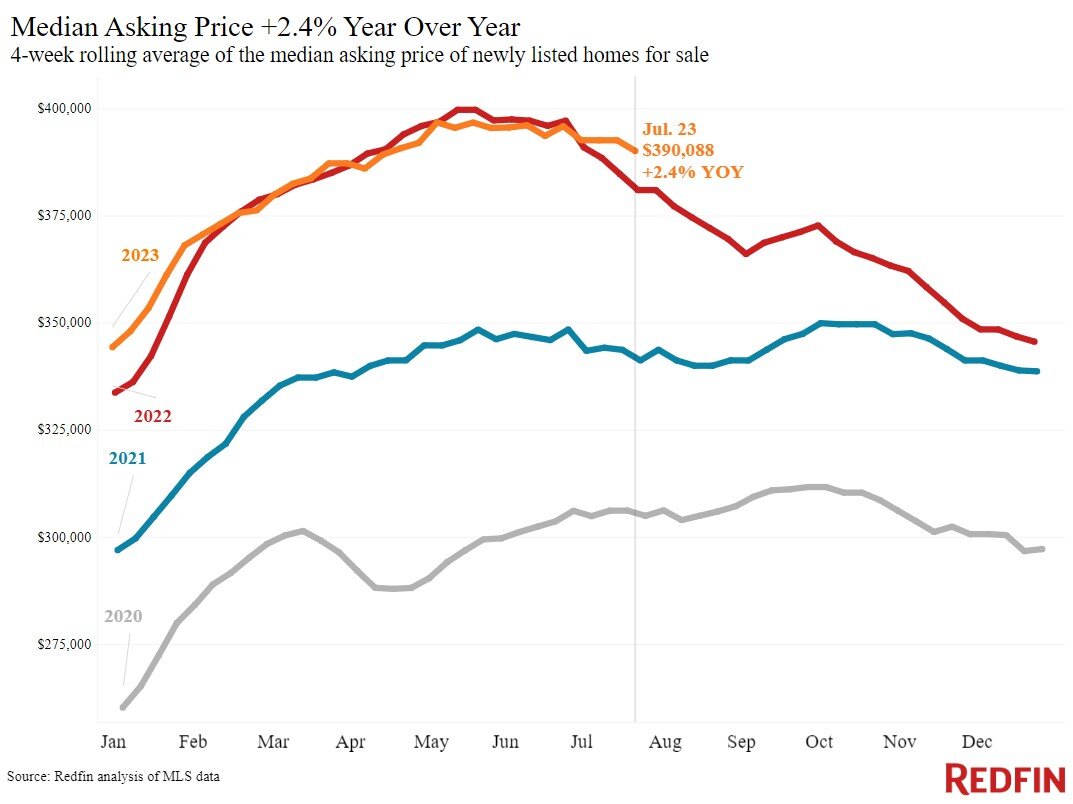

- The median asking price of newly listed homes was $390,088, up 2.4% from a year earlier. That's the biggest increase since January.

- The monthly mortgage payment on the median-asking-price home was $2,599 at a 6.78% mortgage rate, the average for the week ending July 20. That's down about 2% from the record high hit two weeks earlier, but up 16% from a year earlier.

- Pending home sales were down 14.8% year over year, continuing a year-plus streak of double-digit declines.

- Pending home sales fell in all but two of the metros Redfin analyzed. They declined most in New Brunswick, NJ (-32.7% YoY), Newark, NJ (-32.1%), Providence, RI (-27.8%), Warren, MI (-27%) and Boston (-25.4%). They increased 2.7% in Las Vegas and 1.4% in Austin.

- New listings of homes for sale fell 21.6% year over year. That's a substantial decline, but the smallest in nearly three months.

- New listings declined in all metros Redfin analyzed. They fell most in Las Vegas (-45.2% YoY), Phoenix (-38.9%), Newark, NJ (-34.3%), Providence, RI (-32.9%) and New Brunswick, NJ (-31.7%).

- Active listings (the number of homes listed for sale at any point during the period) dropped 16.9% from a year earlier, the biggest drop since February 2022. Active listings were down slightly from a month earlier; typically, they post month-over-month increases at this time of year.

- Months of supply was 2.8 months, the highest level since March. Four to five months of supply is considered balanced, with a lower number indicating seller's market conditions.

- 43.9% of homes that went under contract had an accepted offer within the first two weeks on the market, on par with the share a year earlier.

- Homes that sold were on the market for a median of 27 days, up from 22 days a year earlier.

- 36.3% of homes sold above their final list price, down from 45% a year earlier.

- On average, 5.7% of homes for sale each week had a price drop, slightly below 6% a year earlier.

- The average sale-to-list price ratio was 100%. That's down from 101% a year earlier.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Residential Rents in U.S. Continue Annual Decline in June

- U.S. Migration to Most Flood-Prone Areas Has Doubled Since the Pandemic

- Mortgage Rates Slightly Dip in Mid-July in the U.S.

- New Home Mortgage Applications Spike 26 Percent in June

- U.S. Home Sales Down 23 Percent in First Half of 2023 Says NAR

- Despite Rising Rate Concerns, Builder Confidence Edges Higher in July

- Just One Percent of Homes Have Changed Hands This Year in the U.S.

- Mortgage Rates Rise Again in U.S.

- Rent Growth for Single Family Homes Continues to Slow in May

- Home Values in U.S. Reach New Peaks in June

- Orlando Area Residential Sales Down 18 Percent Annually in June

- Homebuilders Tell Congress ESG Policies Harm Affordable Housing Production in the U.S.

- Globally, Waterfront Properties Enjoy a 118 Percent Price Premium in 2023

- U.S. Foreclosure Starts Increase 15 Percent in First Half of 2023

- U.S. Residential Asking Rents Still Close to Record High in June

- U.S. Housing Inventory Drops to Lowest Levels Since 1999, Says NAR

- Annual Home Price Growth in America Drops to 11 Year Low in May

- Southwest Florida Housing Markets Hit by Hurricane Ian Bouncing Back

- Mortgage Delinquencies Remain Near All-time Lows in U.S.

- Global Home Price Growth Slows to Lowest Levels Since 2015

- Mortgage Rates in U.S. Reach New High in 2023

- Greater Las Vegas Area Home Sales Down 14 Percent Annually in June

- U.S. Mortgage Applications Dip in Late June

- Greater Palm Beach Area Residential Sales Dip 6 Percent in May

- Americans Prefer Walkable Communities

- Phoenix, Las Vegas and Miami Most Popular Destinations for Family Relocations in 2023

- U.S. Pending Home Sales Dip in May

- Ireland Home Prices Dip Nationwide in Q2

- U.S. Homes Post First National Price Declines in Over a Decade

- U.S. Homebuyer Affordability Further Declined in May

- Luxury Branded Residences Enjoy Global Growth Despite Economic Uncertainties

- Greater Fort Lauderdale Area Home Sales Dip 12 Percent Annually in May

- Mortgage Applications in U.S. Increase in Mid-June

- Greater Miami Residential Sales Continued to Slide in May, Down 25 Percent Annually

- U.S. Home Sales Slightly Upticked in May

- Investor Home Flipping Profits Remain at 10-Year Lows in Q1

- Active Home Listings For Sale in America Fell to a Record Low in May

- New Home Starts in U.S. Spikes 22 Percent Annually in May

- Buyers Pay More for Homes Painted in Darker Moody Colors in 2023

- U.S. Housing Market Has 40 Percent Less Active Listings in 2023 Than Before the Pandemic